November 11, 2023

Cashless Payment in Japan

The Rise of Cashless Payment Systems in Japan: How Digital Transactions are Transforming the Way Japanese Make Payments

Cashless payment systems in Japan are on the rise, transforming the way Japanese make payments. Discover how digital transactions are changing the landscape of payment methods in this technologically innovative country.

Today, we are going to talk about cashless payment in Japan. With the rapid advancement of technology and the increasing popularity of digital transactions, cashless payments have become a common method of payment in various countries around the world. Japan, known for its technological innovations, is no exception. Lets explore how cashless payment is changing the way transactions are made in Japan.

1. The Rise of Cashless Payment

In recent years, Japan has seen a significant increase in the adoption of cashless payment systems. This shift can be attributed to several factors, including the governments initiative to promote digital payments and the convenience and security offered by cashless transactions.

1.1. Government Incentives

In an effort to reduce cash circulation and stimulate the economy, the Japanese government has implemented various incentives to encourage cashless transactions. One of the most prominent initiatives is the introduction of the Cashless Point Program, which provides consumers with points or discounts when they make digital payments.

1.2. Convenience and Efficiency

Cashless payment methods, such as credit cards, mobile payment apps, and electronic money (e-money) systems, offer a higher level of convenience and efficiency compared to traditional cash transactions. They eliminate the need to carry physical cash, provide faster transaction processing, and allow for seamless integration with other digital services.

2. Popular Cashless Payment Methods

Now that we understand the reasons behind the rise of cashless payment in Japan, lets take a look at some of the most popular cashless payment methods used in the country:

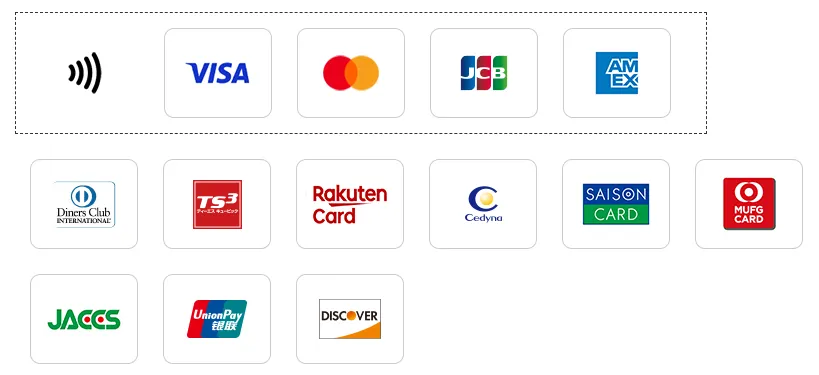

- Credit Cards: Credit cards are widely accepted in Japan, especially in urban areas. They offer convenience and flexibility, allowing users to make payments at various establishments without the need for physical cash.

- Mobile Payment Apps: Mobile payment apps, such as Apple Pay, Google Pay, and various Japanese-specific apps like PayPay and LINE Pay, have gained popularity among both locals and tourists. These apps allow users to link their bank accounts or credit cards and make payments using their smartphones.

- Electronic Money (e-money): E-money systems like Suica, Pasmo, and IC cards are commonly used for transportation and small purchases. These cards can be loaded with money and used to make quick and contactless payments at vending machines, convenience stores, and more.

3. Cashless Chaos

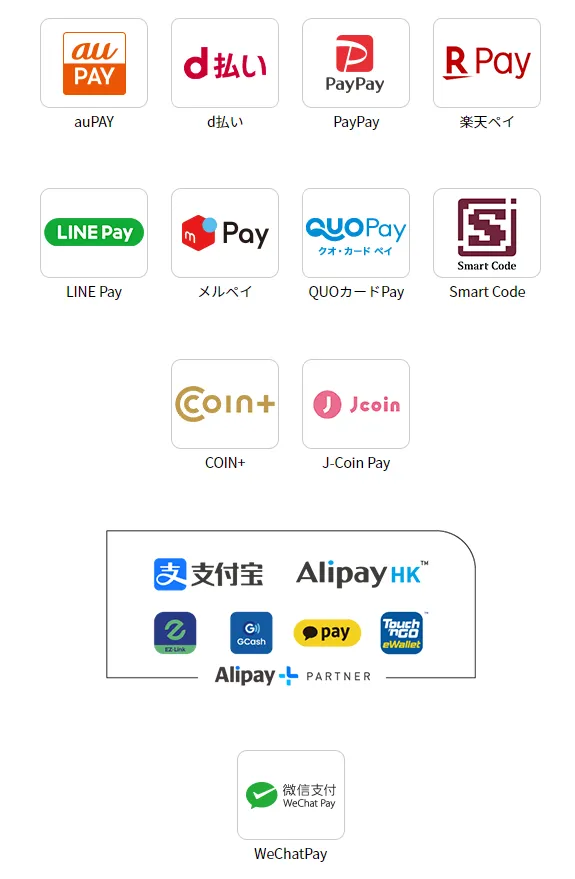

Since cashless industry is very lucrative, many players join the game even if they are a bit late to launch thier services. That resulted the chaotic payment method options. For example, currently convinience stores accepts below payment methods.

Some stores accept this, other restaurants don't, and this place only accepts this... Cashless is convinient, yet this situation isn't really convinient.

4. Benefits and Future Prospects

Cashless payment systems offer several benefits to both consumers and businesses. For consumers, these systems provide convenience, security, and the opportunity to earn rewards through loyalty programs. Businesses benefit from reduced cash handling costs, increased efficiency, and the ability to track and analyze transaction data.

In the future, it is expected that cashless payment methods will continue to evolve and gain further popularity in Japan. The governments initiatives, technological advancements, and changing consumer behavior will drive the growth of cashless transactions in the country.

5. But, Long Way to Go

According to the statistics from Ministry of Economy, Trande and Industry, in 2022, cashless transaction is 36.0% of all transaction made. From that 36%, 93.8% are credit card. Less than 15% is e-money or QR code payment.

That has a big correlation with Japan's aging population. Needless to say, those technologies are more acceptable for younger generations than elderiles.

Conclusion

Cashless payment has revolutionized the way transactions are made in Japan. With the government promoting digital payments and the convenience offered by various cashless payment methods, the country is embracing this technological shift. Whether its using credit cards, mobile payment apps, or e-money systems, cashless payments offer speed, security, and efficiency for both consumers and businesses.