November 13, 2023

Understanding Japan's Monetary Policy

Exploring the Significance and Impact of Japans Monetary Policy in Managing the Economy - Understanding Japans Monetary Policy

Explore the significance and impact of Japans monetary policy in managing the economy in this comprehensive guide. Learn about the actions taken by the Bank of Japan (BOJ) to regulate money supply and interest rates, and how it affects price stability and economic growth.

Japans monetary policy plays a crucial role in managing the nations economy. It involves decisions and actions taken by the Bank of Japan (BOJ) to regulate the supply of money and control interest rates. Lets explore this topic further to understand its significance and impact.

What is Monetary Policy?

Monetary policy refers to the actions undertaken by a central bank to regulate and control the money supply, interest rates, and lending practices in an economy. It aims to achieve specific economic goals such as price stability, low inflation, and sustainable economic growth.

Importance of Monetary Policy in Japan

Japans monetary policy holds significant importance due to the countrys unique economic challenges. For many years, Japan has been battling deflation, which is a sustained period of falling prices and weak economic activity. To combat deflation and stimulate economic growth, the BOJ has implemented various monetary policy measures.

Key Tools of Japans Monetary Policy

- Interest Rates: One of the primary tools used by the BOJ is setting interest rates. Lowering interest rates encourages borrowing and spending, which stimulates economic activity. Conversely, raising interest rates helps control inflation by reducing excess spending.

- Quantitative Easing: Quantitative easing involves increasing the money supply by purchasing government bonds and other financial assets. This injects liquidity into the economy, making borrowing cheaper and encouraging investment and spending.

- Forward Guidance: Forward guidance involves providing clear communication about the future direction of monetary policy. This helps shape market expectations and influences consumer and investor behavior.

Impacts of Monetary Policy on the Economy

Japans monetary policy decisions have a direct impact on the nations economy. The aim is to achieve stable economic growth, low inflation, and avoid excessive deflation. By regulating interest rates, the BOJ influences borrowing costs for businesses and individuals, which affects investment, consumption, and overall economic activity.

When the BOJ implements expansionary monetary policy, such as lowering interest rates or implementing quantitative easing, it spurs economic growth by encouraging borrowing and investment. Conversely, in times of inflationary pressure, the BOJ may tighten monetary policy by raising interest rates to control inflation and prevent excessive price increases.

Current Situation

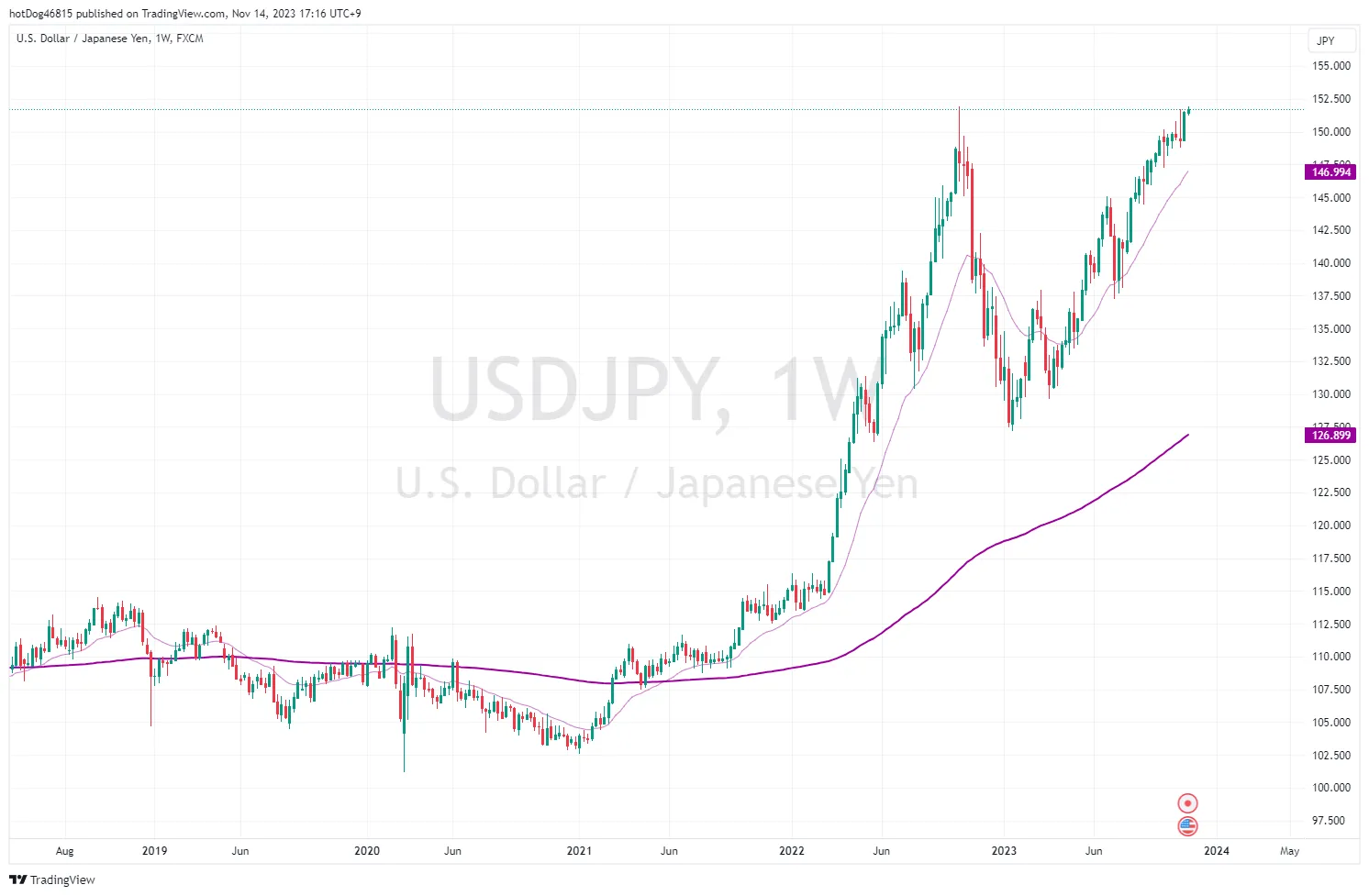

Anyone who needs to exchange Japanese Yen to something else, people talk about weak Japanese yen right now. It was JPY100 for a dollar, but now its JPY150 for a dollar. If you get paid in USD and living in Japan, you increased 150% during the past 3 years without doing nothing.

Due to Mr. Kuroda, the governer of BOJ kept his promise about monetary easing policy ever since he assinged, it seems the stock market appreciate his aggressive cash overflow policy. It's almost doubled from 2020 to 2023.

On the other hand, corporate employees get 1.0-2.0% wage increase per year in 2022 (Ministry of Health, Labour and Welfare: Wage Research), and so as the past wage increases. One of the reasons why we have a gap between haves and have-nots might be this.

In Conclusion

Japans monetary policy is a vital tool for managing the countrys economy and combating deflation. The BOJs decisions regarding interest rates, quantitative easing, and forward guidance have a significant impact on borrowing costs, investment, and economic growth. Understanding the intricacies of Japans monetary policy helps shed light on the nations economic landscape.